QuickBooks Training Accounts Receivable Review (Desktop)

When you don’t have 24-hour access to a QuickBooks Pro Advisor, it can be daunting to manage your own books. One of the best tips we can provide when maintaining your own records is to keep an accurate list of what customers owe you. This is a critical part of running your business.

This article discusses the process of reviewing accounts receivable lists in QuickBooks Desktop. If you are using QuickBooks Online, the process is similar, but the “how to” steps are different. See my next blog post “QuickBooks Training Pt. 2 – QuickBooks Online AR” for specific step-by-step guidance.

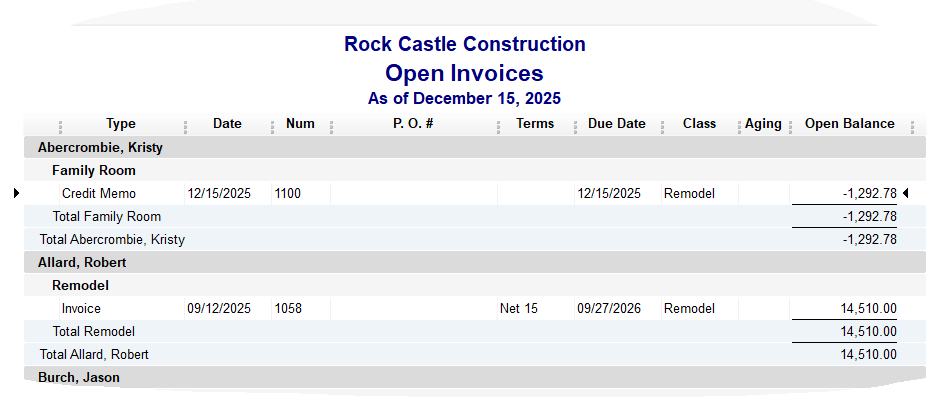

Step 1. Periodically review the report called Open Invoices in QuickBooks Desktop (QBD)

To access this report, go to the Reports Center:

• Click on Customers & Receivables/Open Invoices.

• Then click on the green Run button.

The Open Invoices report displays all unpaid customer invoices, for all years through Today. The Open Invoices report also displays un-applied payments. If you see invoices listed as well as payments in a customer register, you probably have unapplied payments. Apply un-applied payments and record a zero-payment.

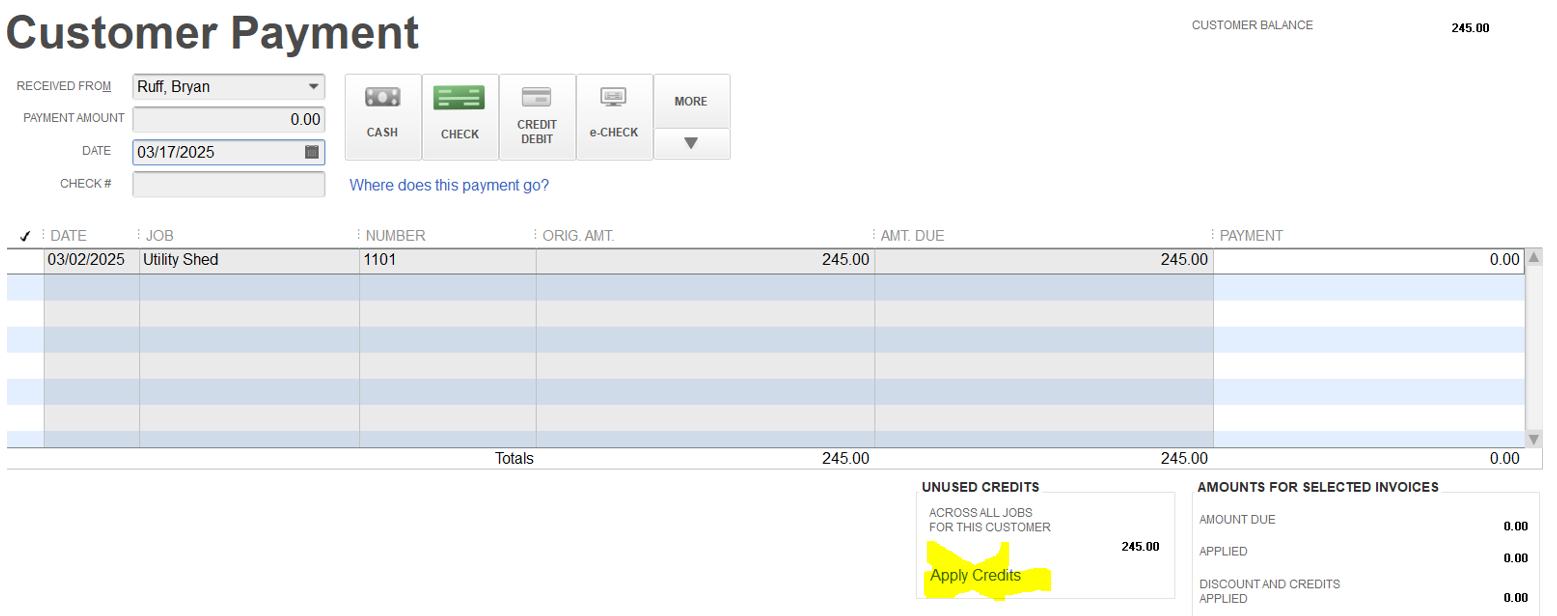

Step 2. Apply un-applied payments

In QBD, from Home screen, in Customer’s windowpane:

• Click on Receive Payment (or in Customer Center, click on dropdown arrow, click New Transactions then scroll to Receive Payment).

• Select the Customer name box (one with un-applied payments) and use zero as the payment amount.

• Use the date of the actual payment, to keep the accounts receivable register intact.

• Click on Apply Credits button.

• In the Apply Credit window, select the credit.

• Finally, click Save and Close, so the payment is applied to the invoice and saved.

Step 3. Review remaining unpaid invoices

Once you have a more accurate Open Invoices report, review the older, unpaid invoices, and contact your customers who owe you. Create a list of invoices that are either erroneous, or need to be written off.

Accrual basis taxpayers face strict rules relating to removing invoices

If you are an accrual basis taxpayer, the IRS is very strict about removing, or writing-off, unpaid invoices. You must:

• prove the invoice is worthless,

• that it is related to your small business and

• you have suffered economic loss.

After exhausting your options and documenting how your customer disagrees, went bankrupt or otherwise won’t pay, you can proceed and remove that invoice.

If you are an accrual basis tax-payer, you haven’t ever recorded the income from unpaid invoices, so this isn’t an issue.

This article only discusses removing invoices for cash basis tax-payers.

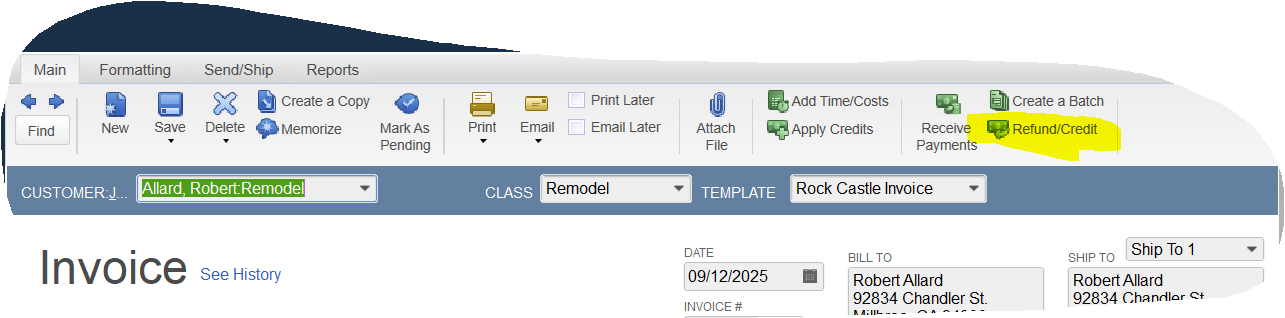

Step 4. Remove erroneous or older invoices you wish to “write off”

Do not delete or void an older unpaid invoice to eliminate it. Instead, leave the invoices in the accounts receivable register intact (and maintain a record of those customers to avoid in the future), and create and apply a Credit Memo to remove the invoice.

Use the date you determine the invoice to be uncollectible in the credit memo.

Create Credit Memo – Cash-Basis

In QBD, go into the invoice you need to eliminate.

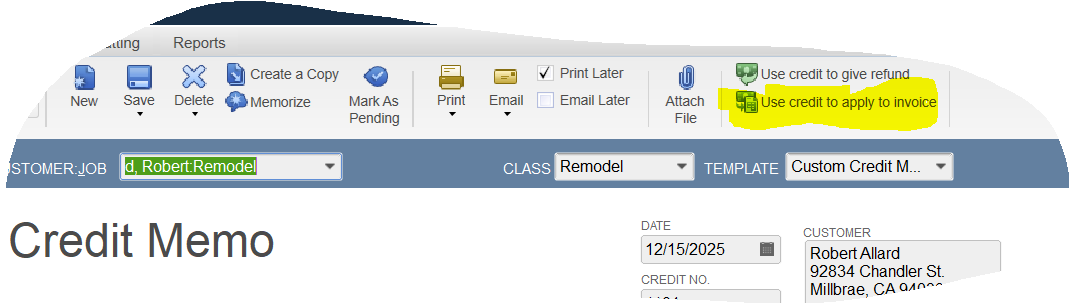

• Click on the Refund/Credit button (in top menu bar near the right side). The credit memo reversing the invoice Item(s), item amount(s) and dollar amounts is created.

• Click on the Use Credit to Apply to an Invoice button (top, right of screen again). The Apply Credits to Invoices window will open with a check mark beside the invoice to credit. You could attach your documentation on collection attempts and save that in the credit memo as well.

• Finally, click Done and the credit is applied to the invoice and saved.

And that is all there is to it! If you revisit your open invoices list you will notice that the list is shorter and more accurate.

Don’t forget to add Accounts Receivable Review to your monthly or quarterly “to do” list, and pay attention to the aging of your receivables list.

Your trusted advisors are here to help. Let us know if you have questions. If you require more QuickBooks training, or if you would like to speak with a QuickBooks Pro Advisor, please contact Amy Siegel.

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA