When we’re talking about tax planning, common questions we receive from clients and potential clients are, “Does our 401(k) plan require an audit?” and, “What triggers the audit requirement for a 401(k) plan?” There are a few different answers to […]

Assurance

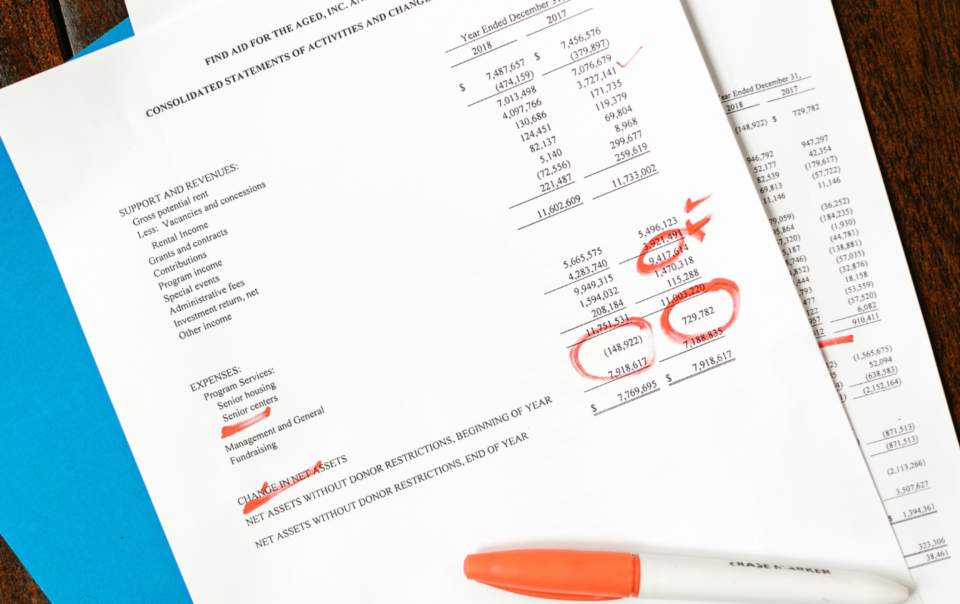

Nonprofit organizations produce financial reports for a number of reasons: internal financial reports for management and the board of directors; financial reports provide to grantors, whether with applications or reporting; the Form 990 filed with the IRS; and audited financial […]

Financial records and reporting are a vital part of managing the operations of a non-profit organization. Without accurate financial recording and reporting, a non-profit organization will be missing a key component in the decision-making process, opening itself up to potential […]

Positive cash flow can be a strong indicator of the financial health of an organization. It’s good to have cash on hand, but can too much cash be a risk to your organization? Read below to gain an understanding of […]

Segregation of Duties (SOD) is fundamental to maintaining internal controls and practicing good risk management within an organization. Over the lifespan of an asset or transaction, the key principle of SOD is that no individual is completely responsible for authorization, […]

In my last post, I listed items required to calculate right-of-use assets and lease liabilities. Outlined below are the components of Excel’s present value formula and how each input can be affected in the application of the new lease standard. […]

As discussed in an earlier post, private companies who prepare financial statements in accordance with generally accepted accounting principles (GAAP) will soon be making big changes in lease reporting. Under the new standard (ASC 842), all leases for a period […]

Are your company’s financial statements prepared under generally accepted accounting principles? Does your company have signed rent or lease agreements for office space, warehouse space, rent, land, or equipment? Do those agreements include services, supplies, or maintenance? Does your company […]

In 2019, the American Institute of Certified Public Accountants (AICPA) issued Statement on Auditing Standards 136, Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA (SAS 136) with the goal of improving audit quality […]

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA