The 50% Test for Low-Income Housing Tax Credit

What is the 50% Test?

The 50% Test is required for every project that receives 4% credits by financing acquisition and construction costs with volume cap tax-exempt bonds. The test is to verify that 50% or more of the tax-exempt bond proceeds are used to finance the aggregate basis of any building and the land on which the building is located. Failure to meet the 50% Test is catastrophic to a low-income housing tax credit project.

What causes a project to fail the 50% Test?

Insufficient allocation of volume cap tax-exempt bonds or cost overruns can make passing the 50% Test challenging. Also, parking the tax-exempt bonds in bond funds and not spending the tax-exempt bonds on construction costs can make a project fail the 50% Test.

What happens if you fail the 50% Test?

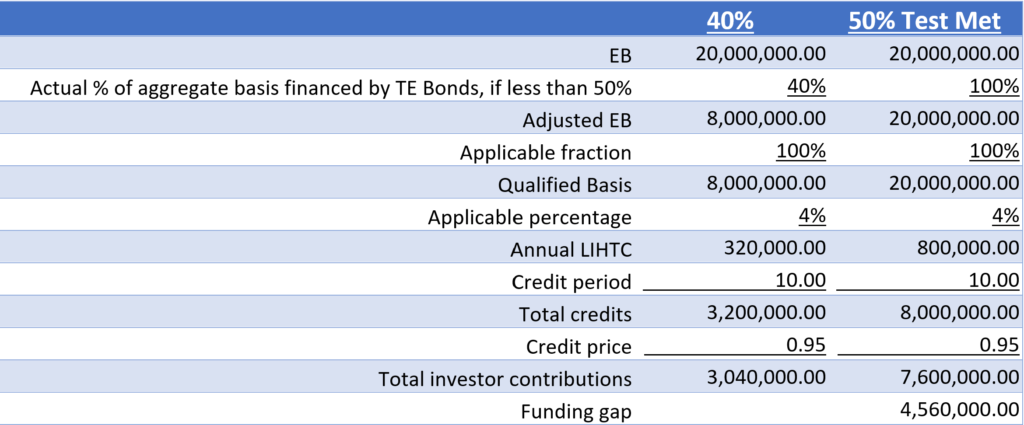

If a project fails the 50% Test, the project only qualifies for credits based on the actual percentage of aggregate basis financed by the tax-exempt bonds. The table below compares a project that failed the 50% Test (Let’s say only 40% of the aggregate basis was financed by tax-exempt bonds) to a project that met the 50% Test.

Tips to developers

Developers should monitor cost overruns and request for the maximum bonds allowed by the bond issuing authority. Each bond issuing authority has different maximum bond amounts it will issue to a project so check with the bond issuing authority before applying for tax-exempt bonds. Also, monitor the use of the tax-exempt bonds throughout the construction period because only the amount of tax-exempt bonds used to pay for the construction costs counts for the purpose of the 50% Test. Make sure to spend all the tax-exempt bonds before the construction is completed and do not redeem the bonds partially or in their entirety, before the 50% Test has been met.

For additional considerations, please reach out to Alex Cho, CPA or contact our Real Estate Solutions Team at Mahoney.

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA