Best Practices for Not-For-Profit Board of Directors

Are you on a new 501(c)(3), nonprofit or not-for-profit board of directors or is your board looking for an update on best practices for the board? Each organization can be different in their structure of their board; however, these five best practices should be at the foundation of every not-for-profit board of directors.

1. Meeting Minutes

Boards of directors should meet regularly to discuss strategic, operational and financial performance. Best practices recommend meeting quarterly. However, it is not uncommon for boards to meet monthly. Regular board meetings promote active participation and keep governance updated. These meetings should also be documented, retained close at hand and easily available for reference. Also, if the board cannot formally meet regularly, it is just as important to document the informal interaction – the emails chains, the impromptu phone conversation and quick coffee break to communicate information. This can act as support when your auditor comes calling, but is also a great reference (like the board minutes) to go back to when the board tries to remember what has been recently discussed or decisions reached in the past.

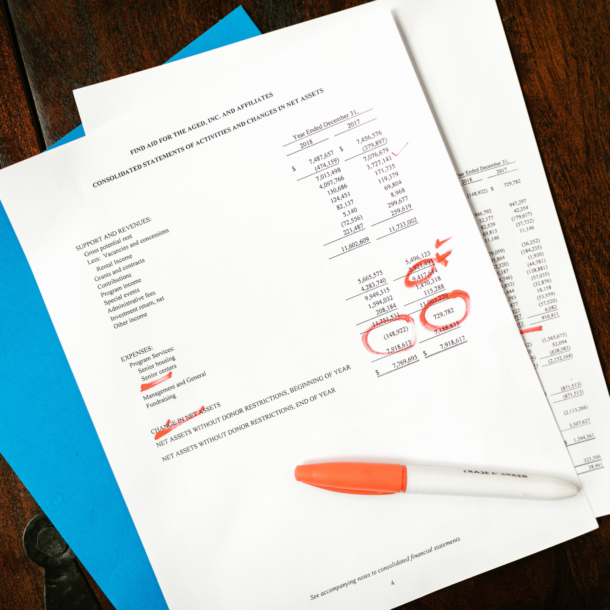

2. Financial Expertise

During board meetings, financial performance will be reviewed as the board has a fiscal responsibility for overseeing the financial operations of the organization, so it is important to maintain or seek an individual with financial expertise to understand and/or ask questions regarding the financials. Maintaining a relationship with a nonprofit accountant or not-for-profit consultant can prove beneficial in this regard. This individual also plays an important role when reviewing annual audits and/or Form 990 at the board meetings by pointing out any unusual items a person without financial expertise would not catch.

3. Whistleblower Policy

It is the responsibility of all board members, employees and any other constituents of the not-for-profit to reports concerns of fraud, illegal matters or nonconformity with policies. It is the board of directors’ responsibility to establish the written whistleblower policy and review the results regularly to protect individuals who come forward with reliable information. An active whistleblower policy communicates to the constituents that the organization is open to hearing the concerns within the organization and creates transparency and accountability.

4. Conflict of Interest

Boards of directors are elected to take on the role of governance for the organization. As governance, they hold high responsibilities for oversight, planning and decision-making through the form of voting. That being said, it is important to disclose any conflicts of interest to ensure no individual is making decisions that would impact their financial or personal interest while voting and/or trying to persuade other board members in voting. The conflicts of interest should be in writing and reviewed regularly.

5. Approve ED/CEO Compensation

As governance, it is the board’s responsibility to hire and set the not-for-profit’s executive compensation. The compensation must be “reasonable and not excessive.” This can be accomplished by reviewing compensation of executives at similarly sized organization in the same industry and location. Deciding the right compensation is vital to retain the best talent in the organization, so it is important to research and document the methodology used.

Does your organization utilize these five best practices? If not, evaluate your organization and propose adding these best practices to the foundation of your not-for-profit board.

For additional considerations please reach out to Sam Broman, CPA or contact our Not-for-profit Consulting team at Mahoney to be of help to you in any way.

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA