S-Corporations: Shareholder Basis & Pass-Through Loss Limitations

S-corporations are considered pass-through entities, which means that income and losses earned from the business are passed down to the individual shareholders’ tax returns. However, an S-corporation shareholder cannot automatically assume that a loss passed through from the company is deductible on his or her individual income tax return. This is where the importance of keeping track of shareholder basis comes into play. For an S-corporation shareholder to deduct a loss on his or her individual return, the shareholder must clear a few hurdles. Understanding what affects shareholder basis and knowing the tax implications of the major pass-through loss limitations is critical for every business owner.

Shareholder Basis in S-Corporation Stock

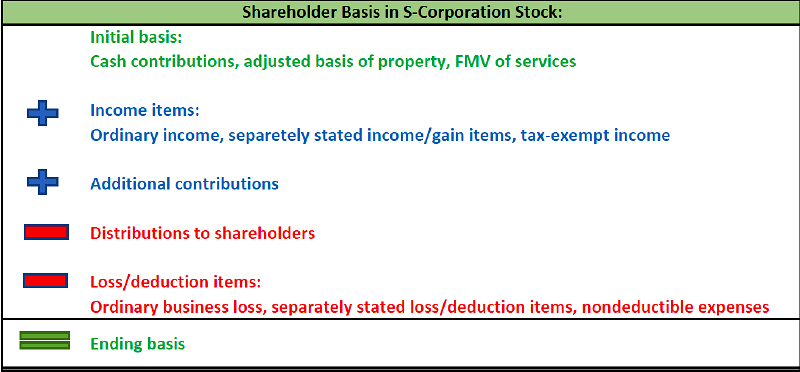

Below is a diagram that summarizes the items that affect S-corporation stock basis:

Tax Planning & Consequences of Distributions

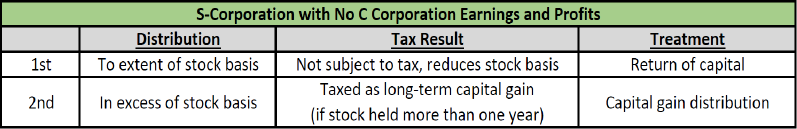

Distributions to the shareholder are not included in the shareholder’s gross income if the distribution does not exceed the shareholder’s basis in the S-corporation stock. The non-taxable distributions are treated as a return of capital and reduce the shareholder’s stock basis. If the amount of the distribution exceeds the shareholder’s basis, the excess is taxed to the shareholder as a capital gain.

If the business has been an S-corporation for its entire existence and has no prior C corporation earnings and profits, the below diagram summarizes the rules for determining the taxability of distributions:

Basis Ordering Rules

- Increased for income items

- Decreased for distributions

- Decreased for non-deductible expenses

- Decreased for deductible expenses and loss items

Tax Basis Limitation

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA