Real Estate Acquisition and Development: Part II

In a previous article it was noted that a real estate project will typically go through three stages:

- The Preacquisition Stage

- The Acquisition Stage

- The Development Stage

Part I of Real Estate Acquisition and Development discussed the first stage, before the purchase of the property, whether costs should be capitalized or expensed, depending on their nature. This article will delve into the Acquisition Stage of real estate, which is essentially a single day.

Acquisition occurs on the closing date when ownership of the property is transferred from the seller to the buyer. To account for this transaction, any costs clearly associated with the purchase of the property should be capitalized. In the preacquisition stage, we differentiated between direct and indirect costs, but at acquisition there is no reason to have them separated. What makes recording the acquisition stage complicated, is how to properly allocate the costs more than to determine what the costs are.

Costs that should be capitalized include the purchase price and other closing costs such as title insurance premiums and governmental fees. Professional fees of attorneys or CPAs and travel costs that are clearly related to the purchase of the property should also be capitalized.

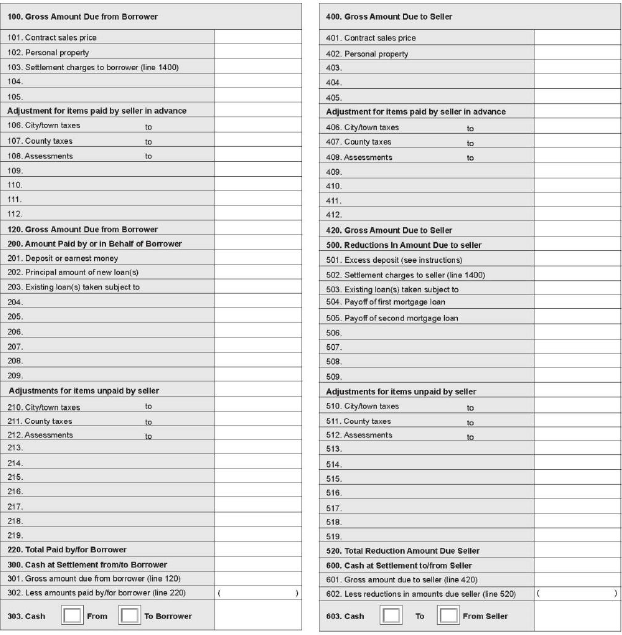

The settlement statement or closing statement lists the buyer and the seller as well as property details similar to the image below. This statement details all costs to be recorded at closing.

The settlement statement is normally 2-3 pages long. The sales price, any adjustments for advance payments, and cash due at closing are all shown on the first page. The remaining sections detail numerous fees such as broker fees, loan fees, title fees, taxes and other charges related to the sale. One thing to watch out for are repayments for preacquisition costs paid at closing. Even though they are paid at closing, they should still be evaluated as preacquisition costs and may in part need to be expensed.

Costs to be capitalized are allocated between land and building based on appraisal or any reasonable method, such as assessed tax value. Certain costs associated with financing should be capitalized as finance fees and amortized over the life of the related loan instead of capitalized to the land or building. Finance fees may be difficult to differentiate from acquisition fees, which will be included in the building value. Loan origination fees, appraisal fees, and application fees are a few items that would be classified as finance fees, while syndication fees would be shown as a decrease in equity and organization/start-up costs would be expensed.

As previously stated, all of these costs should be recorded on the closing date listed on the settlement statement with depreciation for the existing building in service beginning on that same date. The next stage in real estate acquisition is the development stage, which will be discussed in a later article.

Real Estate Consulting

We hope this answered some of your questions about acquisitions. If you need additional help determining tax strategies or building a chart of accounts, let us know. Feel free to contact real estate consultant Katie McDonnell at Mahoney CPAs and Advisors for more information.

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA