Property Taxation: Adjusted Basis and Holding Periods

Generally, there are three ways for a taxpayer to legally acquire property. Personal property is any property that is movable, such as equipment, furniture, collectibles, etc. Personal property can also be intangible, such as stocks and bonds. Real property is land and everything that is permanently attached to it. The three ways to acquire both of these types of property are through purchasing, gifting, or inheriting. The tax regulations regarding the basis and the holding period of the property in each scenario are different. These differences are vital for every taxpayer to understand because they can have significant tax implications when the property is subsequently sold by the taxpayer.

Transfer of Assets

Purchased Property

When property is purchased, the initial basis is the amount paid for the property, plus any additional costs to prepare the property for use and place into service. Examples of these additional costs that increase the basis include shipping costs, installation costs, sales taxes, and testing costs. The basis of the property is then reduced by any depreciation taken by the taxpayer. The holding period of purchased property begins on the date the property is acquired.

Gifted Property

Property acquired as a gift generally retains the same cost basis it had in the hands of the donor at the time of the gift. This is referred to as carryover basis. The recipient of the gift usually assumes the donor’s holding period. However, there is one exception to this rule that must be noted. If the fair market value at the date of the gift is lower than the donor’s cost basis, the basis for the donee depends on the donee’s future selling price of the asset:

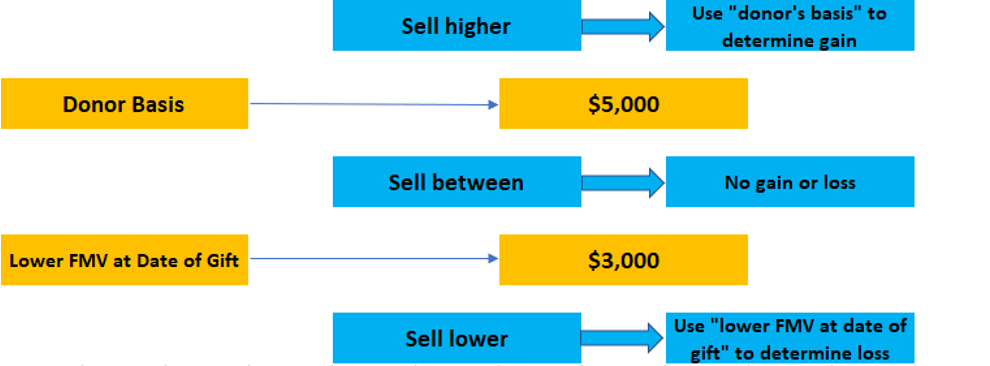

- If the property is sold at a price that is greater than the donor’s basis, the gain to the taxpayer will be the difference between the sales price and the carryover basis.

- If the property is sold at a price that is less than the fair market value at the date of the gift, then the fair market value at the date of the gift will be used as the basis, and the loss to the taxpayer will be the difference between the sales proceeds and the fair market value at the date of the gift.

- If the property is sold at a price that is greater than the fair market value, but less than the carryover basis, the taxpayer will recognize no gain or loss on the sale, and the basis to the donee is the “middle” selling price.

Below is an illustration that summarizes these rules for gifted property:

Inherited Property:

Property acquired by inheritance generally takes a “step-up” or “step-down” in basis to the fair market value at the date of the decedent’s death. The holding period of inherited property is automatically considered to be long-term property regardless of how long it has actually been held by the decedent, which is favorable to the taxpayer.

For additional considerations, especially where a transfer of assets is concerned, please reach out to Travis Koester, Associate, or contact our Tax Solutions team at Mahoney to be of help to you in any way.

Additional Reading: Interested in deferring gains when buying and selling real estate? Read our blog for more insight.

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA