How Do You Bill Your Clients for Time and Expenses in QuickBooks Online?

A QuickBooks Training Guide

There may be times when you have to buy things relating to a specific client’s project, but those costs will eventually be reimbursed to you by the client.

There may be other times when either you or one of your employees spends time providing services for your clients; and you need to keep track of the time and bill the client directly for that time.

QuickBooks Online (QBO) calls these “billable expenses.”

QBO has a built-in “reminder tool” that lets you know about these “billable expenses.” Each time you create an invoice in QBO for a customer with “billable expenses,” the reminder pops up until you either add the time or expense to the customer’s invoice or cancel the reminder. QBO also offers specially designed reports that help you track unbilled time and expenses.

This is how the process works.

Tracking Billable Time

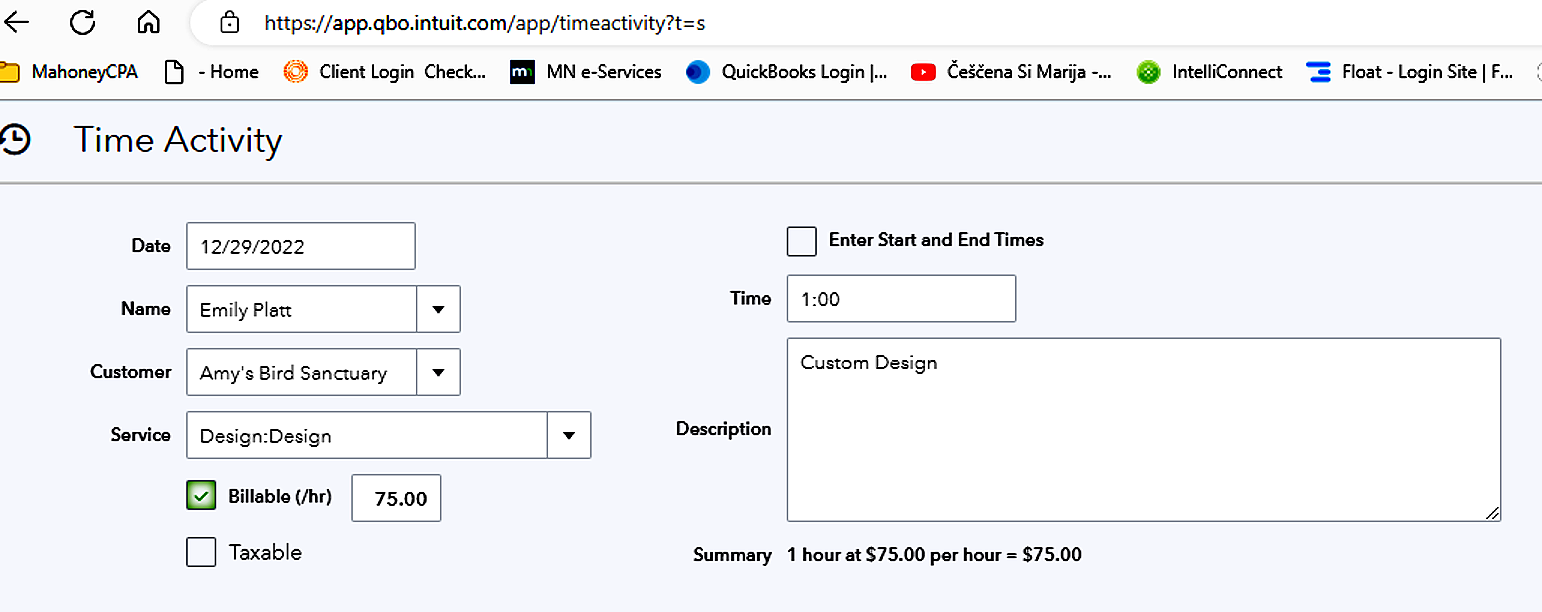

Here is how to add “billable time” activity to your QBO accounting data. Click “+New,” then “Single time activity,” Complete the blanks and select items in the entry fields from drop-down lists until the “form” is completed.

Don’t forget to mark the activity as “billable” (check the box in front of the word “billable”) and add the client or customer name in the transaction field.

For example, your employee’s billing rate is $75/hour. Click the box in front of the word “Billable” to indicate this will be charged to your client or customer. If you wish to “up-charge” the services, enter that number in the billable field.

QuickBooks Online keeps this info about this client in your data file.

Tracking Expenses

Record the client’s “billable expense” in QuickBooks Online the same way that you add all your other expenses. To do this, either click the “+New” button and then “Expense” or click the “Expenses” link in the toolbar and then click “New transaction” and “Expense.” Complete the fields and place a check mark in the “billable” column and add the customer (and project if applicable) name from the drop-down list. Save the billable expense.

Go to the Expense Transactions page to see a table with all the saved billable expenses. To revisit this transaction, click “View” and “Edit” at the end of the corresponding row. The transaction will open, and you’ll notice that there’s a small “View link” in the Billable column. Click it, and you’ll see a small portion of the Billable Expense screen.

If you wish to add markup or overhead costs, click the “gear icon” in the upper right and go to “Account and settings,” and then choose “Expenses.” Click the pencil icon to the far right of the Bills and expenses block of options. Click the box in front of “Markup with a default rate of” to create a checkmark and enter a percentage. All of your billable expenses will now include a markup of the indicated percentage.

Invoicing Time and Expenses

Open an invoice form and select a customer who you know has “billable expenses.” QuickBooks Online will remind you that you have unbilled charges and/or unbilled time in the right vertical pane.

To see the original expense transaction, click “open.” Click “Add” to include the billable expense on the invoice.

Another way to see all your pending billable expenses in QBO is via the “Unbilled Charges” or “Unbilled Time” reports. To find these reports, go to “Reports,” then choose the “Who owes you” section.

The invoicing time and expense feature in QBO can be very useful to non-profits for grant reporting in QBO. Each individual Grant is a “project,” set up under the “customer” or “contributor” who is the grant maker. For grant reporting, keep track of “billable expenses” specific to that grant. Then create an invoice that includes all the billable expenses or run the unbilled charges or unbilled time reports to report on them.

Contact Mahoney with Questions

At Mahoney, we are happy to answer any questions you may have about QuickBooks Online or billing your time and expenses to individual clients. Reach out to Associate Director and QuickBooks ProAdvisor Peggy Prall, and she can assist you in this matter. Don’t miss our other QuickBooks blogs for more tips.

Additional reading: Reconciling Bank States in QBO

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA