Does your nonprofit have a conditional contribution?

Nonprofits do some awesome things in our communities: they serve people in need, promote arts and creativity and help build a more unified community. With all these great things they are doing, deciphering Generally Accepted Accounting Principles (GAAP) is the last thing they want to think about!

Unfortunately, the world of accounting standards has become more complex recently. For fiscal years starting after December 15, 2018 Accounting Standard Update 2018-08 [Not-for-profit entities (Topic 958): Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made] became effective. For most nonprofit leaders, looking at the last sentence probably caused their eyes to glaze over. So, to put this in everyday language: Nonprofits with a calendar year ending 2019 and a fiscal year ending June 30, 2020, should be aware that a new Accounting Standard Update is now in effect. The standard clarified how contributions should be recognized. This was a huge accounting standard update for nonprofits, since most of their income comes from contributions.

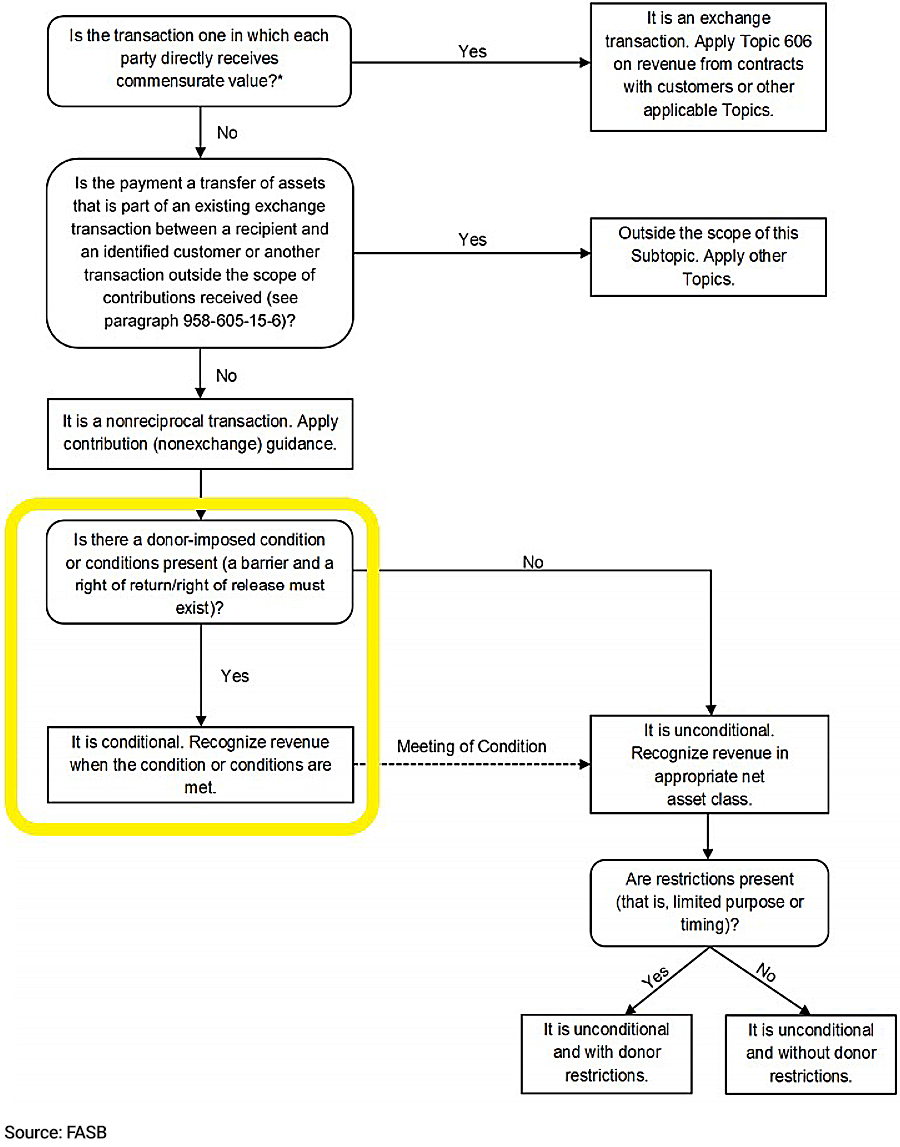

The FASB (Financial Accounting Standard Board) released a handy flow chart (see below) to see exactly how to determine and recognize contribution revenue. The circled section is what I will be concentrating on and will detail how to tell if you have a conditional contribution.

If you follow the flowchart, you get down to the second-to-last box, and it just has some blanket accounting-ese: “a barrier and a right of return.”

What is a barrier?

This is a measurable condition to overcome. A few examples include:

- The nonprofit must perform 10 plays over the summer

- Hiring three new loan administrators

- For specified counseling expenses

- Eligible expenditures for a specified criterion (this is most common in reimbursable grants, where the nonprofit has limited control on how to spend the funds)

- If the contribution says it is restricted for what the application detailed, and then in the application it says the nonprofit will perform five art classes at three different schools

There are a few common mistakes that nonprofits make when evaluating barriers:

Confusing restrictions and barriers

This is the hardest part of determining if you have a conditional contribution. A restriction is a donor-imposed instruction on how the revenue can be used, but the revenue is already earned. While a barrier, like a restriction, must be donor imposed, a barrier is something that must be overcome to earn the revenue. A sign that you have a barrier is that a condition is measurable or very specific (hiring a counselor who speaks Spanish). For example, if a contribution says it’s restricted for a specific program (ex. counseling) it would be a restriction, not a barrier. The difference is there is no way to measure that restriction, and the nonprofit has discretion on what expenses to use to release the contribution.

Another often confusing example: if a contribution is restricted for a specific program and includes a budget, but there is no penalty for not following the budget and no requirement to amend the budget. This would be a restriction, not a barrier. The budget is just a guide for how to use the funds and not something that must be overcome to earn the revenue. This is different than a government grant where there is explicit guidance on how to use the funds and includes a requirement to obtain approval to amend the budget if expenses are not meeting the budget (i.e., more than a 10% difference.)

Reporting requirements do not count as a barrier

If all you must do is send the contributor a report of what you have spent the contribution on, this is not a barrier. This is considered an administrative requirement which is explicitly excluded in the standard because you could spend the funds on anything.

Understanding the right of return

While a barrier can be a little bit subjective, the right of return is more straight-forward. A right of return can present in a couple of ways:

- You must submit a report showing that you have met the requirements, before you receive any funds.

- If you do not spend the money on what the contribution letter or application says, in the correct time frame, you will have to return the funds.

Most contribution letters will have a right of return of some sort stated, so it is important to remember that it is the combination of the right of return and the barrier which make the contribution conditional.

Different contributors can make these barriers and right of returns in many different ways. The best way to tell if you have a conditional contribution is to look at the award letter and see what it says – look for both a barrier and a right of return. Although accounting is not the most fun part of running a nonprofit, recognizing revenue correctly is essential to the continued operation and awesome services nonprofits provide.

For additional considerations, please reach out to Caroline Russell, CPA , Associate Manager, or contact our Assurance Solutions Team at Mahoney to be of help to you in any way.

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA