Benefits of Flexible Budgeting

“A budget is telling your money where to go instead of wondering where it went.”

Dave Ramsey

Attitudes toward budgeting can span from inspired and motivated to disinterested and obligated. Creating a budget involves using your crystal ball; assumptions made at the start of the year become less reliable as the year progresses and conditions change. Using a flexible budget helps you to engage more usefully in planning throughout the year.

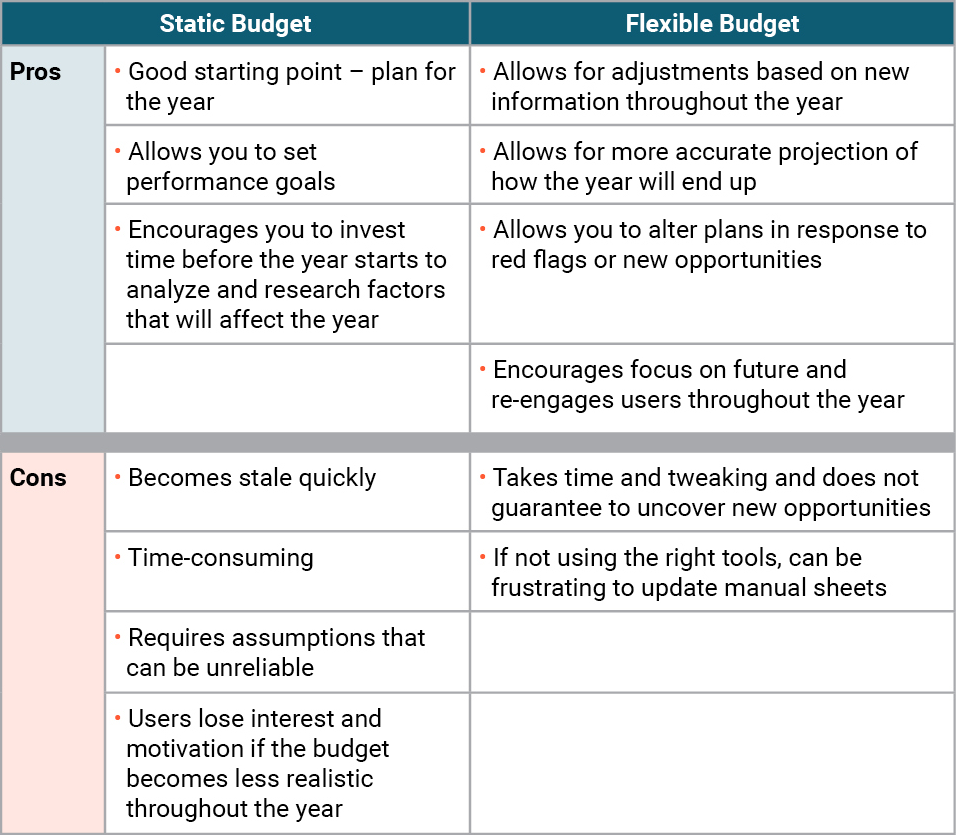

A static budget versus a flexible budget

- A static budget is a budget that, once finalized, does not change. A static budget is a great starting point. It is best practice to employ at least a static budget to compare to your actual activity and to point out fluctuations from your expectations.

- A flexible budget is updated throughout the year. It reflects changes in your assumptions due to actual sales levels achieved, changes in costs or any other condition that affects how you expect the remainder of the year to go.

Some leaders perceive a flexible budget as not rigid enough, allowing for too much correction based on actuals. The key is to use your static budget where necessary to track goals and performance while using your flexible budget to better pivot throughout the year as conditions change. Both budgets can be useful.

Best practices

Here are some best practices to follow when considering your budget:

- Excel is a commonly used budgeting tool and is better than not budgeting, however using accounting or budgeting software that can integrate with your books, update in real time and reduce cell formula errors is best.

- Use software that allows you to enter more than one budget for a period so that you can retain a static budget as well as the flexible budget.

- Don’t let the year pass by without adjusting the flexible budget. Set milestones and schedule time to make updates. As renowned speaker Michael Altshuler notes, “The bad news is time flies. The good news is you’re the pilot.”

- Encourage participation at multiple levels to get the most up-to-date information from the boots on the ground. Using a tool that works in the cloud allows multiple users access and provides updates in real time, which is ideal. Many solutions allow different users to have specific access in the event you need to keep information for different segments confidential.

- Track expectation for changes in fixed costs as well as any changes in margins expected due to changes in variable costs.

- Stay “big picture” when updating the flexible budget. Static budget preparation is the time for research and detailed assumptions; flexible budget updates should allow you to notice trends in costs, acknowledge known fluctuations in fixed costs coming up and update sales projections based on large accounts landed or other unexpected loss in revenue streams.

- Remember that sticking with original budget assumptions is not a failure – simply asking how reasonable the budget assumptions remain has the benefit of allowing you and your leaders to focus on what is to come. Even if the budget doesn’t flex, which is rare, you are still reaping the benefits of taking a breath and looking ahead.

For additional considerations, please reach out to Ruth Lott, Director, or contact the Business Solutions team at Mahoney to be of help to you in any way.

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA