REST Easy with Mahoney April 2023

Important News for the Affordable Housing Industry

Applicable Federal Rates (AFR)

| Annual | Monthly | |

| Short-Term | 4.50% | 4.41% |

| Mid-Term | 3.70% | 3.64% |

| Long-Term | 3.74% | 3.68% |

| Annual | Monthly | |

| Short-Term | 4.86% | 4.75% |

| Mid-Term | 4.15% | 4.08% |

| Long-Term | 4.02% | 3.95% |

| Annual | Monthly | |

| Short-Term | 4.30% | 4.21% |

| Mid-Term | 3.57% | 3.51% |

| Long-Term | 3.72% | 3.66% |

| Annual | Monthly | |

| Short-Term | 4.43% | 4.34% |

| Mid-Term | 3.56% | 3.50% |

| Long-Term | 3.79% | 3.72% |

Upcoming Deadlines

Low Income Housing 9% – MHFA HTC 2023 Round 1 Tax Credit Allocation Applications – 7/13/2023

MHFA

Carryover Application: 11/1/2023

Final CPA Certification: 5/1/2023

CPED/St. Paul PED

Carryover Application: 11/1/2023

Final CPA Certification: 5/1/2023

Dakota County CDA

Carryover Application: 10/16/2023

Final CPA Certification: 10/2/2023

Washington County CDA

Carryover Application: 10/2/2023

Final CPA Certification: 5/1/2023

Other

Partnership Tax Return Due Date with Extension- 9/15/2023

Individual and C Corp Tax Return Due Date with Extension- 10/16/2023

If you have not submitted your 8609 package, please do so as soon as possible to ensure receipt of Form 8609 by the 9-15-23 tax return due date if claiming credits in 2022 tax year.

Ensure your buildings were leased-up by 6-30-23 if you are taking advantage of IRS Notice 2022-5 for taking credits in 2022

Legislative Updates

By Anjelica Smith

IRS issued Notice 2023-29 on April 4th, 2023, providing guidance to the eligibility requirement for an energy community for the bonus credit program under the Inflation Reduction Act of 2022. The bonus credit program provides up to 20% points boost to the investment tax credit for solar and wind energy projects. Notice 2023-29 details the areas in which an energy community can be recognized. It has three appendices that list the counties for the different types of energy communities listed in the Inflation Reduction Act of 2022; certain metropolitan statistical areas and non-metropolitan statistical areas (MSA/non-MSA), brownfield sites, and census tracts where a coal mine closed after 1999 or a coal-fired electric generating unit was retired after 2009.

Biden released a budget proposal in March of 2023 that contained $28.3 billion to expand the low-income housing tax credit, $15.6 billion for the neighborhood homes tax credit, $73.3 billion in spending for the U.S. Department of Housing and Urban Development (HUD) and $341 million for U.S. Treasury’s Community Development Financial Institutions Fund. These are large increases for HUD and the U.S. Treasury’s Community Development Financial Institutions.

The DASH Act was introduced in 2021 but has since been reintroduced as of March 2023. A few things included in this act are expanding the 9% housing credit by providing a 50% basis boost to projects that prioritize extremely low-income renters, a basis boost to rural and tribal projects, reducing tax-exempt bond financing thresholds for 4% credit deals from 50% to 25%, and more.

By Anjelica Smith

Minnesota legislators passed a $1 billion housing bill on May 9th. This bill includes $46 million to rent assistance, $150 million in down payment assistance for first generation homeowners, $200 million to housing infrastructure programs, $90 million to rehabilitate naturally occurring affordable housing (aging low-rent apartment complexes), $45 million to homelessness prevention. There is a metro sales tax hike included in this bill. These sales tax dollars will go to different affordable housing programs in Minnesota. Half will go to metro county housing assistance, a quarter to state rent assistance for housing vouchers in the metro, and the last quarter to housing aid for metro cities.

Energy Tax Credits: Bonus Credit for Domestic Content

By Trent Senske

Initial guidance on the bonus 2%/10% tax credit for utilizing domestically produced content was released in Notice 2023-38 on May 12, 2023. The notice describes certain rules that the Treasury Department and the IRS intend to include in the forthcoming proposed regulations regarding the domestic content bonus credit requirements. Follow the link below to read the full notice.

Treasury Department Releases Guidance to Boost American Clean Energy Manufacturing

New Minnesota Housing Bill Provides $1 Billion in Funding

By Veronica Naranjo

Minnesota legislators approved a new housing bill on May 9th that is expected to be signed by Governor Walz May 15. The bill includes $1 billion in spending on different housing programs and a 0.25 percent metro area sales tax increase to fund affordable housing. Approximately $792 million is expected to be spent in fiscal year 2024, and the remaining $274 million is to be spent in fiscal year 2025.

The sales tax increase is dedicated to affordable housing and only applies to the seven-county metro area. This tax is expected to raise approximately $150-200 million a year. Of the money raised, 25% is set to fund a new state-based program for rent vouchers, with the remaining to fund housing programs in the metro.

The bill also includes the following:

- $95 million in additional spending for the Economic Development and Housing Challenge program for a total of $120.85 million in available funds during the 2024-25 biennium. The EDHC provides grants or loans to affordable housing developments that support economic development, redevelopment, and job creation.

- $90 million for new Community Stabilization Program to help preserve the naturally occurring affordable housing.

- $200 million to down payment assistance programs, including $150 million in down payment assistance for first-generation homebuyers. This money is expected to create over 4,000 new homeowners.

- $50 million for Home Ownership Assistance Fund

- $200 million in housing infrastructure to be utilized under the same eligibility guidelines as Housing Infrastructure Bonds.

- $39.5 million for the Workforce Housing Development program, which funds housing in communities with proven job growth and a demand for workforce rental housing.

This $1 billion bill is the most that Minnesota has ever spent on housing.

Preliminary Guidance - Bonus Investment Tax Credit (Solar and Wind Facilities) in LIHTC Projects

By Will Bates

The IRS released preliminary guidance on February 13, 2023, in IRS Revenue Notice 2023-17 regarding the bonus investment tax credit available for energy projects in low-income communities made available through a competitive application process.

The bonus investment tax credit applies to projects that are placed in service after 12/31/2022 and begin construction before 1/1/2025. Facilities placed in service prior to being awarded an allocation are not eligible to receive an allocation.

As of this writing, we are still waiting for final guidance from the Department of the Treasury on the application process administered by the Department of Energy and additional criteria that will be considered as part of the application for the Low-Income Communities Bonus Credit Program.

As a reminder, for the total IRC Section 48 credit amount, while the depreciable basis will need to be reduced for 50% of the credit, the eligible basis under Section 42 is not reduced for the credit.

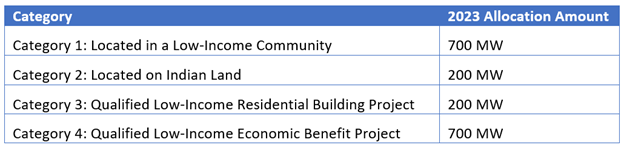

There is an energy capacity limitation for the competitive bonus investment tax credit available in the 2023 calendar year of 1.8 GW (information for 2024 calendar year will be released at a later date) allocated as follows:

Applications will be accepted during a 60 day application window for Category 3 and 4 projects beginning in the third quarter of 2023, with Category 1 and 2 project applications to follow. Applicants may only apply under one category each year. Section 42 projects will largely be included under Category 3.

Once you have received a notice of an allocation, you will have 4 years from the notice date for the property to be placed in service. The increase is 10 percentage points if the eligible property is part of a Category 1 or 2 facility but not also a Category 3 or 4 facility. The increase is 20 percentage points for property that is a part of a Category 3 or 4 facility.

What's Happening at Mahoney Development Services, LLC (MDS)

By Andy Hughes

Mahoney Development Services, LLC (MDS), an affiliate of Mahoney assists Real Estate Developers and Investors with consulting and advisory services to manage the busy development projects in their Real Estate portfolio. See below for what’s going on at MDS.

MDS is gearing up for a busy application season to Minnesota Housing and other local funders. The team is working on a variety of projects including metro and greater Minnesota as well as new construction and preservation for new and current Mahoney clients. Andy Hughes, MDS’s development consultant, also had the opportunity to participate as a panelist at the Affordable Housing Summit on 5/9, sharing his expertise in application and financing structuring for affordable real estate projects in Minnesota. Finally, MDS continues to work through closings on previously funded projects, with two projects closed earlier this year and one more anticipated for July.

Out and About with The Real Estate Solutions Team

By Alex Cho

The Real Estate Solutions Team at Mahoney has been out and about attending various firm events and affordable housing events in our community. Please take a look and see where we have been recently.

Placeholder

April 20, 2023 – Members of our team attended the Grand Opening Celebration of Alliance Housing’s 3301 Nicollet project. This is a 64-unit property that includes 24 units for formerly homeless. For more information on this property click here.

May 4, 2023 – Members of our team attended a fundraiser breakfast for Aeon, who works to preserve and build new affordable housing. For more information about Aeon, click here.

May 10, 2023 – Members of our team attended the annual PPL breakfast fundraiser. This breakfast brings together supporters of affordable housing. For more information about PPL click here.

May 11, 2023 – Members of our team attended the SR Realty Trust Annual Shareholder Meeting and Symposium. This informative event included speakers Spencer Levy, Global Client Strategist and Senior Economic Advisor for CBRE and Brad Schafer, CEO, and Steve Norcutt, COO, from SR Realty Trust.

May 11, 2023 – Members of our team attended a MNCPA Young Professionals Group event at Top Golf. To learn more about MNCPA YPG, click here.

REST Employee Spotlight

By Megan Brownell

Hi, my name is Megan Brownell, and I wanted to introduce myself a little bit to those of you I may not have met yet and introduce myself a bit more to those of you I have. I joined the Real Estate Solutions Team at Mahoney as an Associate in September 2020 after graduating from Augsburg University. I enjoy working on all our Real Estate Solutions projects but especially enjoy forecasts and cost certifications.

When I’m not working, you will most likely find me spending time with my fiancé and our families and friends, playing with my dog Archie, or curled up with a good book. In December 2022, we rehomed an 8-month-old French Bulldog. It’s pretty safe to say our lives revolve around him and I am completely obsessed with him (see cute picture above). He just turned one and is still as wild as ever, but we wouldn’t change that for the world.

By the end of the year, my email will be changing, and I will no longer be signing them as Megan Brownell. I’m getting married at the end of September 2023 to my boyfriend of almost six years and will be changing my name to Megan Bacon (yeah, I know – queue the food jokes haha). My fiancé has been preparing me for all the jokes and comments he received growing up, and I’m pretty confident I’m ready for it.

If you have any questions about real estate development, please feel free to reach out to me via email at mbrownell@mahoneycpa.com, or connect with me on LinkedIn.

Photo credit for this section: Megan Brownell

REST Employee Spotlight

By Sam Neutz

Hello, my name is Sam Neutz. I recently graduated Southwest Minnesota State University with my bachelor’s degree. My next goal is to obtain 150 credits and begin working on completing the CPA exams. This past busy season was my first busy season spent at Mahoney, where I completed my second internship.

I am originally from Maple Lake, a small town in central Minnesota. I currently live in downtown Saint Paul, just a couple blocks away from CHS Stadium. I moved to the Twin Cities this past October, and I’ve been enjoying the change of scenery since.

My dad works as the head of building and grounds for my local high school. My mom teaches middle school special ed at a nearby town. My little brother Dan works as a lineman for Wright-Hennepin Electric. My little sister Sarah is getting ready to attend college in South Dakota. My other little brother is currently in high school and recently got his driver’s license. The family cat, Twinkie, is quite beloved, despite half the family protesting otherwise. My family owns and operates a small hobby farm that has a batch of cows, pigs, and sheep. The farm is generational and was originally bought by my great-grandparents.

I love travelling. I’ve made several trips to the East Coast to visit my girlfriend, Taylor, over the past year. I’ve also visited New York City this past Christmas, where I got to go up to the top of the Empire State Building and visit the Rockefeller Center Christmas Tree. I love going on visits to Duluth and the towns along the coast of Lake Superior. I’m currently planning on going up to Duluth at least twice this summer.

You can contact me at sneutz@mahoneycpa.com

Photo credit for this section: Sam Neutz

ADDRESS

10 River Park Plaza, Suite 800

Saint Paul, MN 55107

(651) 227.6695

Fax: (651) 227.9796

info@mahoneycpa.com

© 2024 Mahoney | Privacy Policy

Mahoney Ulbrich Christiansen & Russ, PA